Community info and helpful resources

Blog

Featured Article

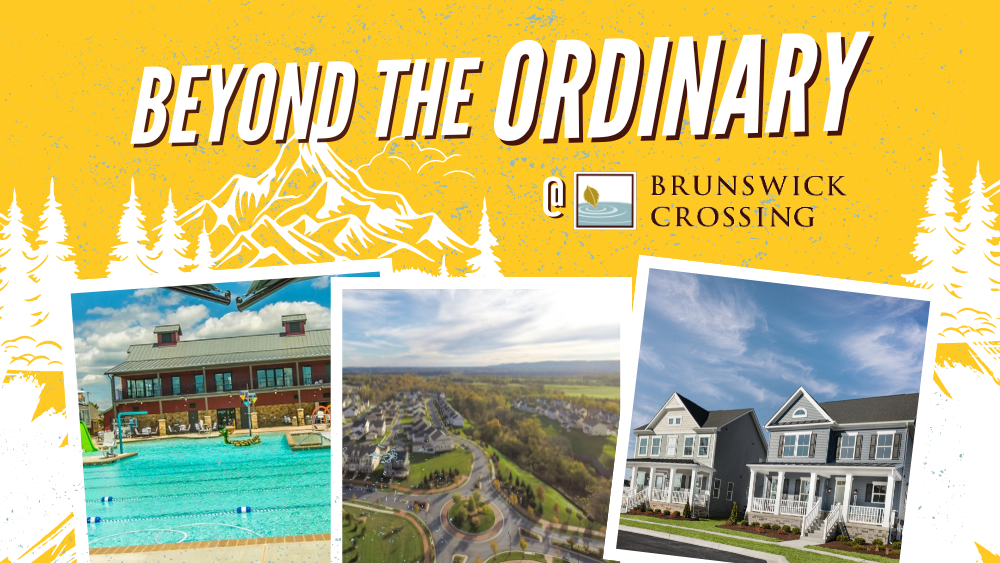

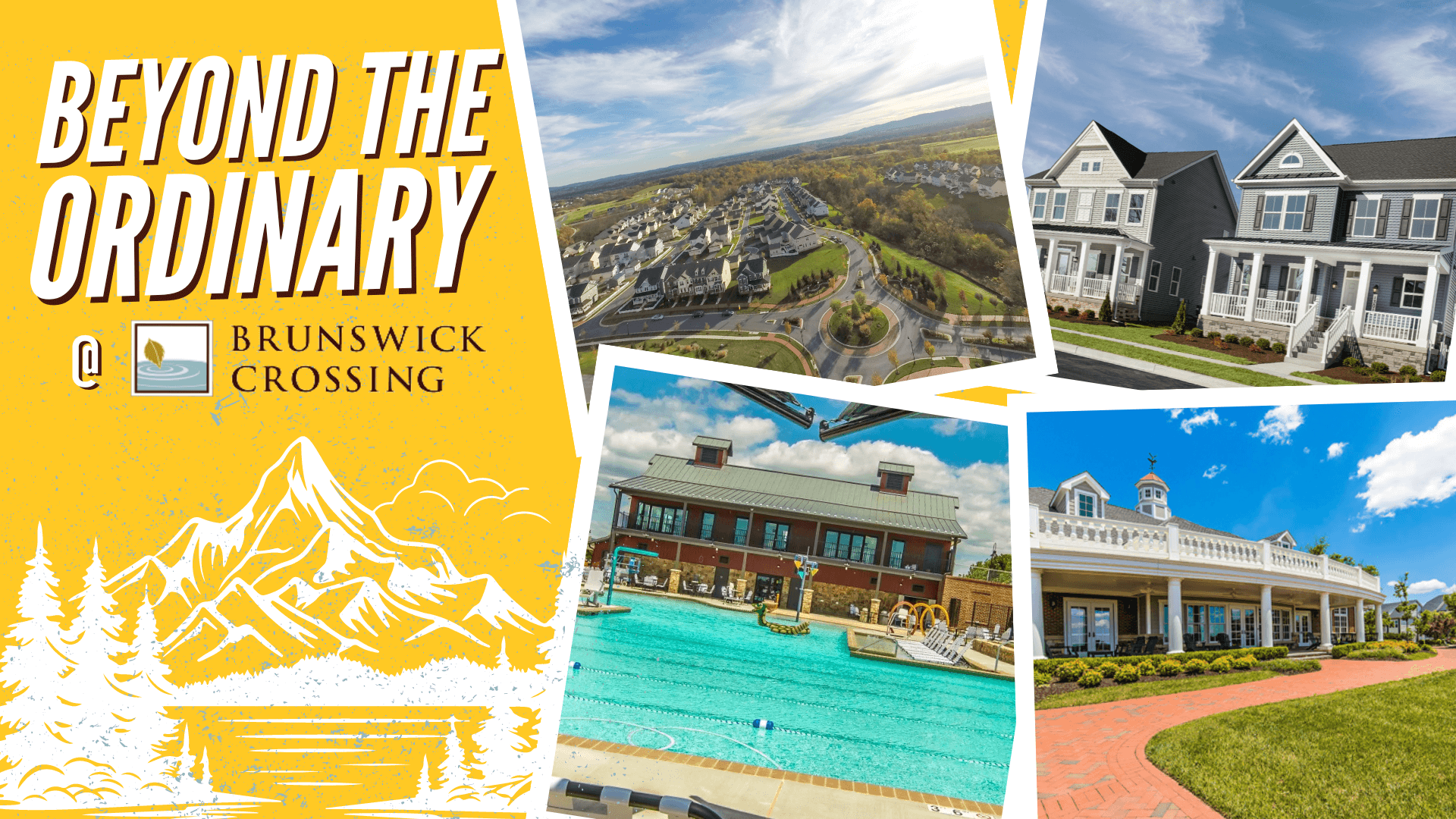

Brunswick Crossing in Frederick County is a hidden gem beyond the ordinary. With two reputable builders offering various home options, a strategic location that strikes a perfect balance between convenience and tranquility, and resort-style amenities that cater to every lifestyle, this community is designed with you in mind.

Recent Articles

Welcome to Brunswick Crossing, where every square inch of your home is designed with you in mind. With our two award-winning builders and 11 distinct home designs, the possibilities for customizing your living space are more exciting than ever. Each home offers upgrade options with the flexibility to personalize your home to fit your family and ...

You're in the market for a new home in Frederick County, proudly ranked as a top location for home buyers in Maryland, and your search is met with various options. As Maryland's largest county by total area, ...

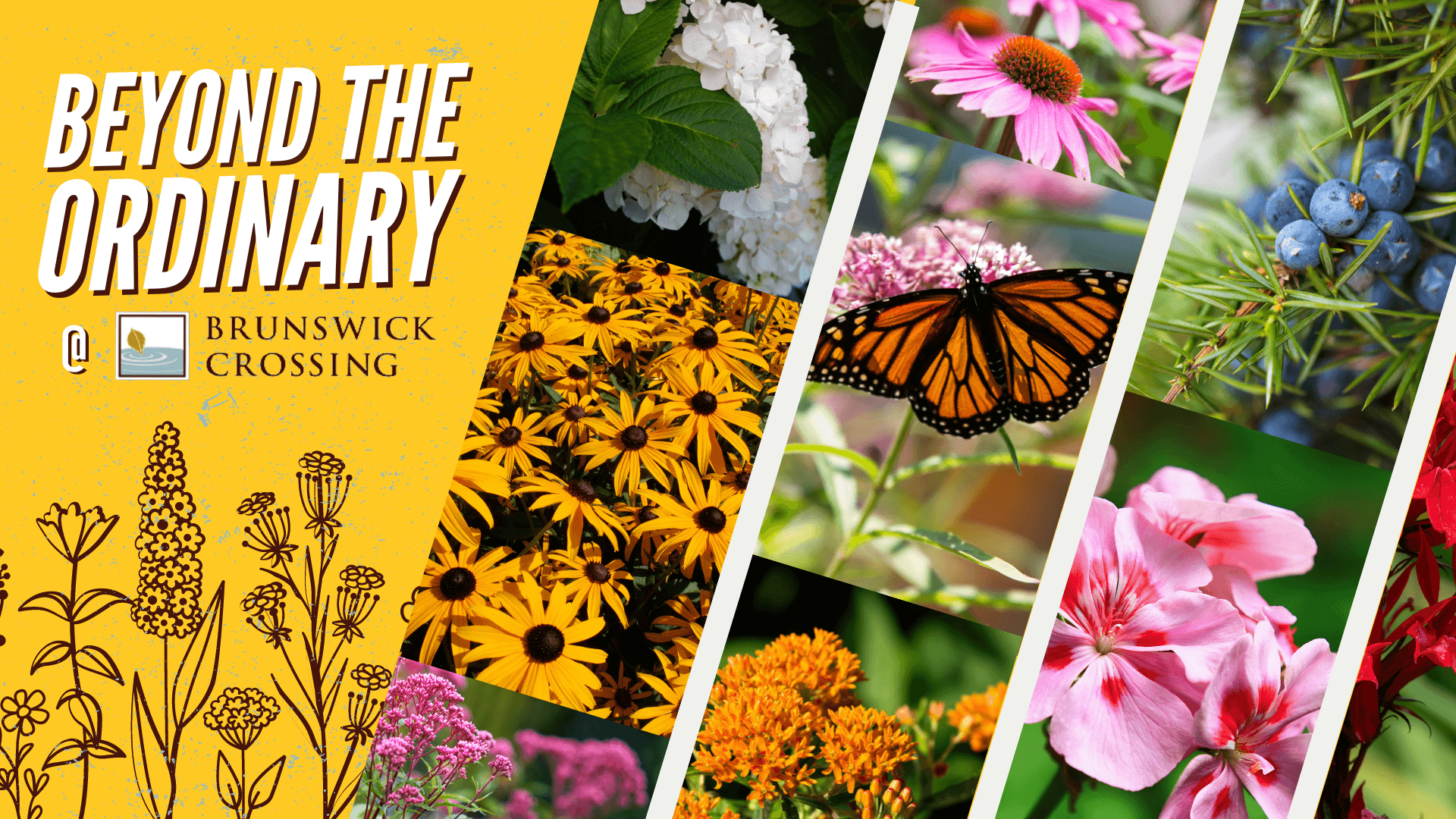

In Frederick County, Maryland, specifically in the area around Brunswick Crossing, is home to a great variety of native plants. There are over 1,500 species of plants along the Potomac River, right in Brunswick Crossing’s backyard.

A community pool, walking trails, pocket parks, and clubhouse. The new home communities that have grown and thrived in Frederick County have all followed a similar list of amenities. Feeder schools, walkability, computer routes, and other outside location influencers are also taken in account when ...